GME is getting a lot more attention over the last couple of days than it has been due to the first major price action and high volume days in months.

Ryan Cohen has said and shown that long term company profitability is his major goal - and not just incidental quarterly profit, like we last saw from Q3 2022.

Under Cohen’s leadership, GameStop has closed underperforming stores and opened new distribution warehouses along with revamped the company infrastructure for organizing orders and which employee benefits are provided. We have seen the gradual impact since he took over in a difficult time for a brick and mortar store - and teetered on profitability last quarter.

2023-07-31 $-0.01

2023-04-30 $-0.17

2023-01-31 $0.16

2022-10-31 $-0.31

2022-07-31 $-0.36

2022-04-30 $-0.52

2022-01-31 $-0.50

2021-10-31 $-0.35

2021-07-31 $-0.21

2021-04-30 $-0.25

2021-01-31 $0.31

I expect us to beat last years $-0.31 in tremendous fashion, but I don’t know that we’ll see positive EPS just yet. How about $-0.09 … reasonable and grounded? Still a great improvement moving forward, and less than the previous two quarter year-over-year jumps.

Meanwhile, leading into an anticipated earnings, we are seeing massive and sudden price action and volatility out of seemingly nowhere. Although I personally prefer the ongoing stability / downtrend to keep accumulating shares in a company that has a strong cash position, close to no debt, and which is positioned in an industry strong in poor economic times. Though the market sometimes disagrees, most families feel these conditions are difficult and are tightening their belts.

Either way, I enjoy adding a few shares every week. This week is no different.

How is everyone feeling?

While I do think earning will be up, I think that this uptick is going to be a rug pull for options. But since I don’t play options, I will just continue to buy and Drs all my shares and shop at GameStop whenever possible. Looking at a new set of speakers this weekend. 🐏☺️

I did a review on some speakers in the drs discord. Just search my name and review. Should come right up.

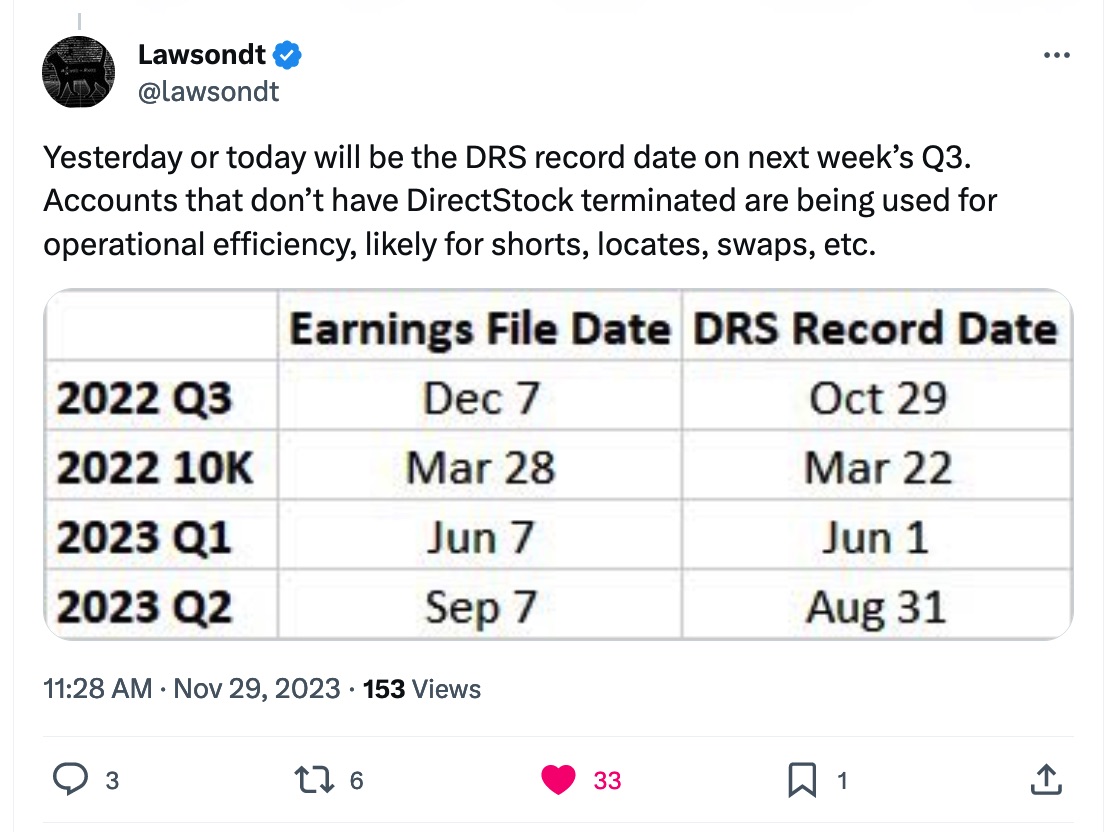

Just remember, this volume/price movement may be nothing more than the heat lamp pump/dump they’ve done many times on/around cutoff day. Cutoff day is typically 6 or 7 days before the 10Q. The Oct 29 (month early) cutoff a year ago was an anomaly.

This in my opinion is the most probable. I forgot about the pump and dump prior to earnings! Thanks for the wonderful Heatlamp DD you created @6days1week

There’s a good possibility this is the reason.

This theory makes sense to me.

The defense holds water… I believe this to be most likely. And you all are geniuses.

nice post!

feeling about as good as i possibly can. i don’t really know how to put it into my words but to me it feels like something is brewing.

-$0.09 is reasonable and grounded and definitely achievable.

on yahoo finance it shows analyst consensus (number of analysts: 3) earnings estimates at -$0.08 per share, which, if nothing else, shows that a large loss like last years Q3 loss of -$0.31 is not expected.

the way i see it:

- not ideal outcome: earnings equal to or worse than -$0.08 per share.

- good outcome: earnings better than -$0.08 per share.

- very good outcome: earnings above $0.00 per share

- crazy good outcome: earnings above $0.00 per share and a positive supplementary announcement of some kind

Hah! I can’t prove it, but I did not check a single analyst expectation before posting my own. Interesting that I’m more bearish than the average sentiment.

Can’t stop this train, clearly. Go RC!

Shill! Shill! Hey everyone we got a shill here!

If we’re doing a billion in sales for the quarter i hope rc can squeeze out at least a 2% margin… daddy needs +.07… daddy chill.