Joke of the day

What did dad say when mom asked him to get groceries?

You’ve got to come with me. It’s Twosday.

Early lunch!

Wow so healthy 🤣 I try to eat like this sometimes but it’s usually just two eggs and some veggies with some dressing for breakfast.

deleted by creator

Crosspost to c/food as well plz 👉👈

It’s healthy but I know it doesn’t look very appetizing leh, paiseh hahahah -_-

It’s okay uhuk

Hmm, is that freshly cut avocado? If not, I’m surprised it hasn’t oxidised while being kept in a lunchbox!

Cut it this morning around 6am! :D

Wow, I didn’t know they could last that long!

I squeezed some lemon juice to delay oxidization! :D

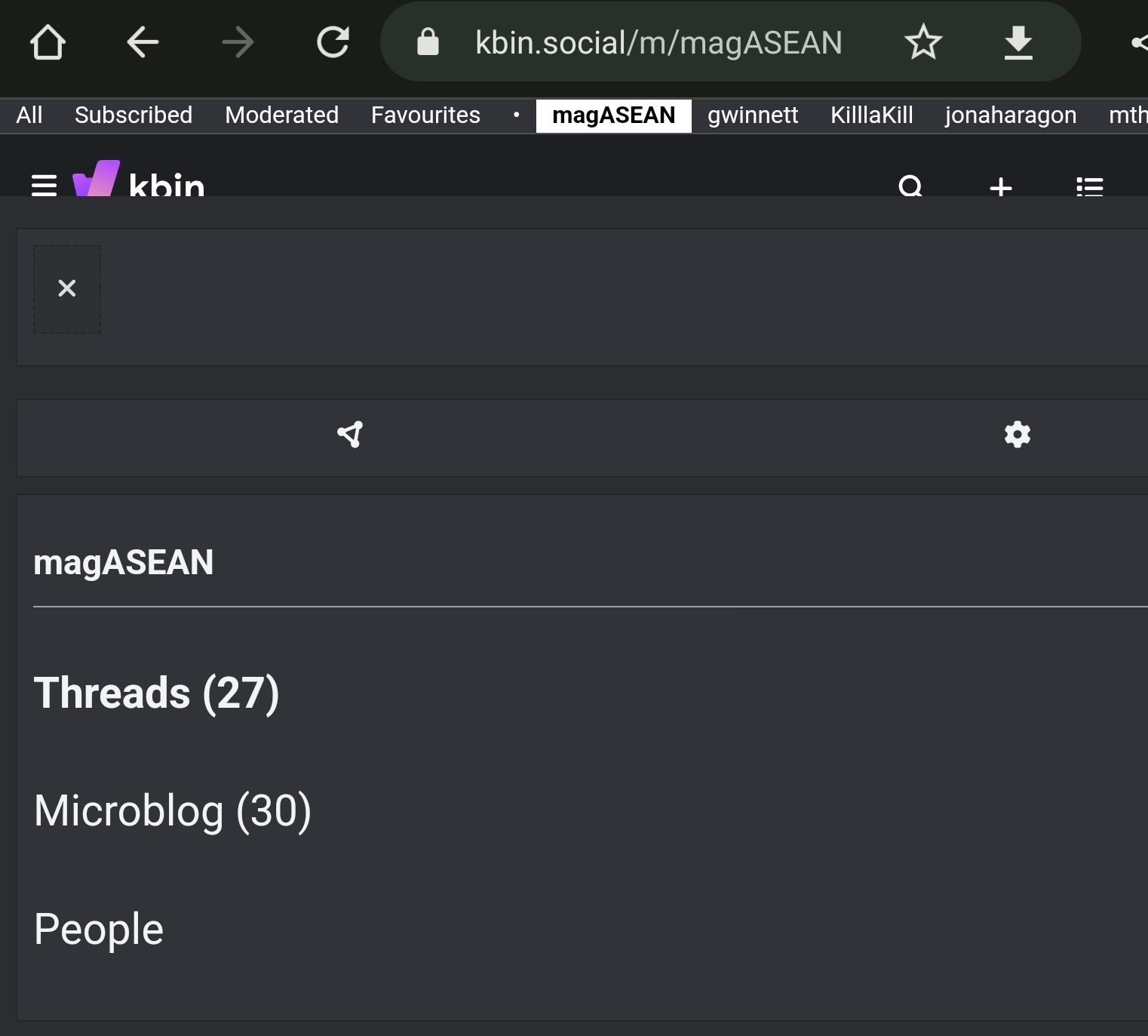

BTW, come contribute to this regional SEA magazine that i set up on kbin.social: https://kbin.social/m/magASEAN

And just in case not aware, kbin has a microblog section because they basically slurp content from the fediverse microblogs. If you click on the kbin logo on the left, you can see this nav tab like in the screengrab. The mag tracks posts that put MakanApaToday and TootSEA up top so if you want to also add food and other Fedi posts pls do!

lemme try have a local link to it…

monyet.cc/c/magASEAN@kbin.socialthere we go. the power of the fediverse is coursing through my veins! 💪

sparkly anime eyes Phwoar more powah

I find kbin hard to navigate, always so lost whenever i tried it. Maybe because i treat it like another reddit instead of something new :x

Yeah it’s definitely it’s own beast, closer to being a forum than a reddit imo. I’m also still trying to wrap my head around the use case, tho it was explained to me it’s supposed to be a link aggregator for fediverse content. Kot.

But lemmy also link aggregator what 🙈

if anyone is interested, I’ve found 2 more lemmy-like federated link aggregators:

- https://brutalinks.tech

- lotide (instances I’ve found: https://narwhal.city https://lotide.fbxl.net https://lotide.nfld.uk)

they are much simpler though, and will probably not be rivaling lemmy and kbin any time soon.

dem, that kinda remind me of the early internet haha

to bring back more memories, have a look at https://fedibb.ml (which also has a small surprise 🙂)

Yaaaa i don’t really know the lore well but before this month, Lemmy was chugging along slowly2 with most ppl on fedi not really finding the need for it + the reputation of the devs being tankies. Kbin not even six months, this kid was just building on PHP code he got elsewhere to do both link aggregation and microblogging. As it was heating up (like shy2 announce got flagship instance etc) more ppl were trying it out (because non-tankie option? Wheeee). ETA: and unlike Lemmy the aggregation to include Fedi content is why the microblog section of the magazines slurps content from other blogs. Then Reddit Migration happened lmao. The tankie issue is still there but the redditor energy of doing their instances or choosing the existing non-tankie ones, and more developer energy to layan a fork should anything happen is also why Lemmy got a fresh burst of life, frankly.

Hm, I’m not really a fan of jerboa so far. Time to give this on a try

Thankiew! Will check it later

deleted by creator

Yay! My boyfriend will be attending with me too (if we can get tickets). Any idea how much they will cost?

deleted by creator

Time to save up 🥹

Yeah I registered at once to get my favourite song 😍

All the best to you in getting the tix!

deleted by creator

got extra room for one more ah? wanna tag along hahahah

deleted by creator

Thoughts on this insurance? My current company’s insurance coverage is very good, but it might not be the same once I jump ship. I’m thinking that maybe I can go with this insurance for a few years, then purchase a better plan later. Is this a good idea?

deleted by creator

I see many people saying investment linked policies are bad though… And ILPs especially have very high commission fees which throws people off. Should I be wary of these? I do plan to start my own financial investments pretty soon too 😥

Investment-linked policies also have different types and they will ask what’s your risk appetite and how soon do you want to see returns.

I’ll say this much: with few exceptions, not a single fund can beat the market overall. Some years you’ll do better, some years you’ll do worse. Consider it as a way to park excess money, but if you’re eligible for the Amanah Sahams, take those instead.

Eh, shouldn’t I treat investments and insurance apart tho ? 😅

I’d say so, but ILPs will be a dominant part of a typical agent’s sales pitch so if you don’t prep you might get caught up by their catalogue. But at least you got that clear!

Thanks for the great insight by the way! The one thing that bothered me is the base plan was life insurance and TPD, which wasn’t what I really wanted(I’m mainly looking for medical insurance). I guess I just need to think what I really and get a plan that I really need, then only add riders as years go on.

deleted by creator

Yeah I’m aware of that… But I probably start it too late either. The latest I intend to start is 5 years later, and if I seem my financial stability good enough I’ll start earlier

I guess people saying ILP are scams made me really paranoid. And I realize that even ILP can’t protect from rising costs and you might still have to increase the amount you pay. Most people came out saying it wasn’t worth it anymore and just stopped?

They’re not scams per se, it’s just their dividend payouts don’t really come higher than market returns. Which makes sense then if you just go straight to an index fund. But we don’t have those. The closest we have are mutual funds that acts like index funds.

Investment i do believe is something you ought to decouple from insurance. And seeing your answer I just want to emphasize that because your early 30s is the absolute last best time to get a good rate on your premiums so if you need to prioritize, priority should go to insurance (you’re likely not to have chronic conditions, so they can’t deny you coverage for preexisting etc. You want them on the hook for having to cover your diabetes for example, not give them the opportunity to deny this + you have to pay higher premium because higher risk)

deleted by creator

That sounds fair… I guess it’s all about the ezpectations. And no I’m not you are an insurance salesman haha 😂

+1 on not shopping around for insurance every few years - your premiums do get recalculated when you switch (i.e. you can’t say I got such and such rate from precious package). So if you can afford a good package go for it. If your company offers a package that’s also good - but pursue your own. The company insurance thing is an American norm that got exported (make money mah) but one consequence is that it’s meant to keep you tied to a company (because in the US especially the risk of having no cheap coverage is real - this is not the same for us luckily). So think of the company plan as a benefit, but not your actual insurance. If you have both, simply use the company one first so your personal premium won’t be affected (because no paperwork to induce them to recalculate your risk).

With this insurance package it’s a good option but it does assume even as b40 you can get online. So there’s this dimension. But insurance coverage is definitely an issue (especially for a society like us that prefer to privatize a range of social protection instead of expanding the public spending here) so i can see why this is being in the regulatory sandbox (IE they’re testing to see if this can be viable - it’s not quite as experimental as a pilot so that’s good).

Would i say this is good tho? Based on the video, it depends. A lot of the stuff they want to cover is basic stuff but most people in the market they target don’t even have that.

I see… It’s just that I prefer not to jump too fast into purchasing insurance and I don’t want to spend too much and get over insured :( I’m still doing research on what’s the best way to move on

One way to keep your head straight and not be tempted by all the riders (extra package) is to shop for the one that can give life + medical basic coverage of up to 99 years with a monthly premium you can tahan. That’s it. You can always add the riders later. But if you want to consider, consider the one with the women health coverage - that’s always a good rider.

Of course, the most ideal scenario is to not think about this at all because we all get universal public health coverage with decent service. But we know that’s a sector that’s dying of a thousand cuts (to the budget)

(And you’ll always be over insured… Since it’s an industry of probabilities they are counting on you not getting hit by a terrible accident. Idk if that pov helps lololol)

So i’ve been playing these flashcards and in just a few hours youtube gave me this video

I know what google tracking does, but i’m still impressed.

was it just me, or did this site go down (gateway time-out) for a short while at around 7pm?

Hey guys… sorry to inform that there was an issue with the server earlier. But everything is back to normal for now. 😅I am currently investigating the issue

Yes, can’t access it on my side as well

eh is this pinned already? sorry I just saw ;_;

It’s ok, you can pin the other one.

Does it work now?

Yup. Thanks, Naomi.

o7 np

What is o7 ? Is it hand behind the head?

it’s a salute

Yeah hand behind the head.

Anyone knows where to play pickle ball in Malaysia? Just wanna experience it, heard there’s a club on top of 1u but seems too atas for me

Ooo, who did the banner for the site?

Haha, figured it’s her, very recognisable style!

Where did monday go…

As of this post, approximately 9 hours and 2 minutes ago. LOL

Back to where it belong.