Foreign LLC continues to acquire land in California critical to energy and national defense.

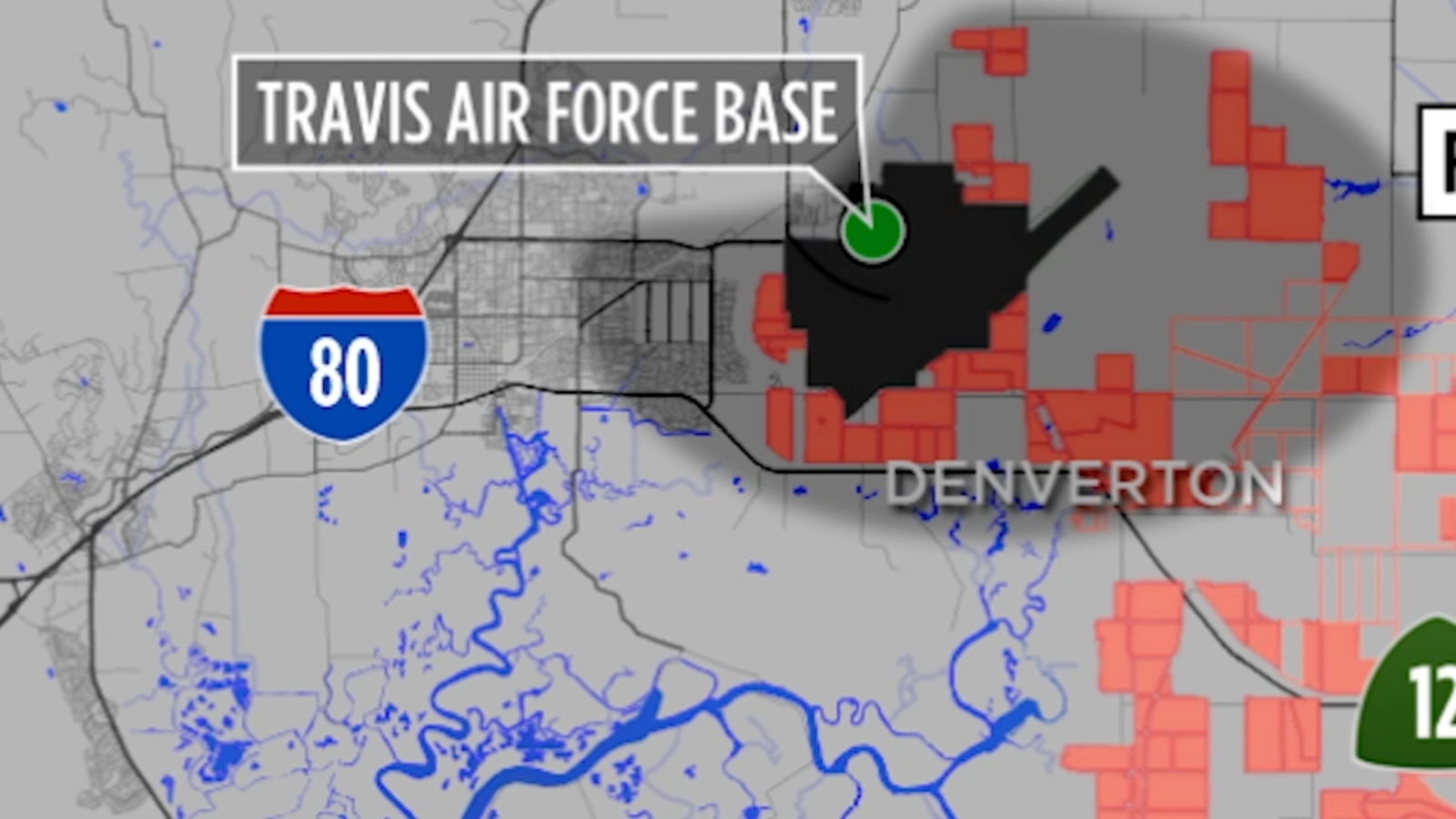

FAIRFIELD, Calif. (KGO) – The United States Air Force is investigating a company that’s purchased $800 million of land near Travis Air Force Base, one of the most critical military bases in the U.S. But after eight months of investigation, government officials have been unable to identify who’s behind it nor rule out any threat to national security.

Flannery LLC was founded 4 and 1/2 years ago and was registered to a Washington DC-based law firm.

There is no information about the actual ownership of this LLC. The previous Reddit thread from 4 years ago has some interesting tidbits of information that you may be interested in reading in addition to the new article.

https://www.reddit.com/r/Sacramento/comments/c96bkb/a_mysterious_corporation_has_quietly_bought/

What’s additionally interesting is that the land that they acquired around Travis Air Force Base will be bayfront property with future sea level increases of between 3 to 5 ft. NOAA has predicted the sea level increase will blow by that with a 7.2 ft average global sea level rise by 2100.

So either we have a secretive Chinese back shell company acquiring critical infrastructure and land for spying on American military assets, or a very optimistic wealthy investor with way too much money and is getting creative in what kind of investment schemes they park their money in.

Quick somebody find a way to link this to China so we can get the GOP to start yelling about limiting foreign investment in US real estate. With a little luck we might can wrangle this into something that will lower the cost of housing.

Have we tried building more housing? I know radical idea.

Yeah, it keeps getting bought up and turned into airbnbs.

If you allow land to be turned into an investment opportunity why would anyone whos got that kind of money put a regular house there and sell it when they could just make it a permanent investment at the cost of other people not being able to buy houses to live in.

This is the real issue right here. It’s more than just Airbnb’s, though, it’s all ‘investment real estate’.

The solution would be to exponentially increase taxes for those who own multiple properties, but property tax is typically handled on the county level, so this would be tricky. Also, the people who could implement such a tax all own multiple properties, so there’s a conflict of interest there.

Canada is struggling with this at the moment. It’s a great idea on paper, but our development style is unsustainable and we simply can’t keep up with demand. Not to mention that build costs are up 50% since 2020.

Affordable, efficient housing that is close to amenities is what is needed, but supplying that is quite unlikely given build costs and North America’s infatuation with the suburb.

Yeah none of that is true. We are nowhere near the limit of how fast we can build and build cost go up when mother fucking office workers are “working” remotely. My company caught one of our reps lying about doing a site walk. Also burbs are everywhere. Might as well call rice Japanese Grain while you are at it, but what do I know. Not like I was quite literally in Frankfurt Germany this month and saw them.

There’s a good chance that China was a one harassing US Navy warships a few years ago.

https://www.thedrive.com/the-war-zone/drone-swarms-that-harassed-navy-ships-demystified-in-new-documents

Not definitive however.

Lowering retail investment will not lower the cost of housing - quite the opposite.